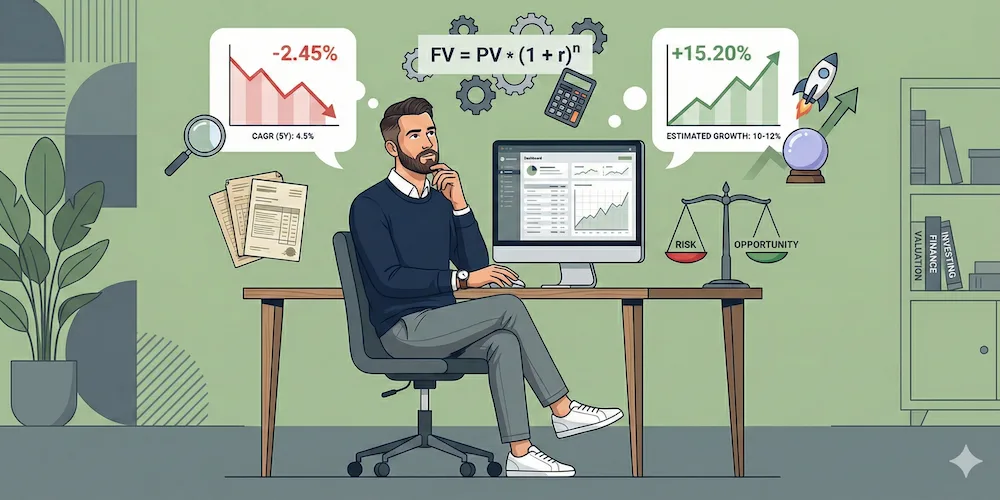

Take control of your investment analysis

EmpowerYour Fundamental

Research

Calculate intrinsic value, assess margin of safety and inform your investment thesis with clear data.

Try Value Sages FreeSuitable for beginners and experts alike

20+

Years of financial data (where available)

Automated Analysis

Customizable and transparent valuation models

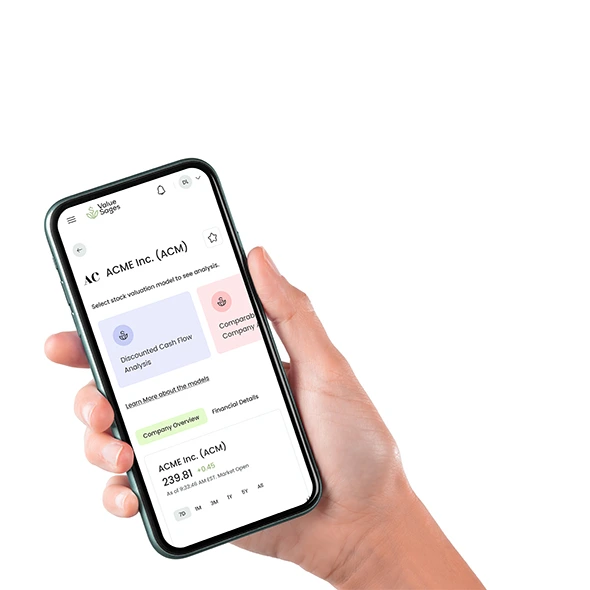

Platform Walkthrough:

See Value Sages in Action

Define your own growth and risk inputs to calculate a personalized Fair Value and Margin of Safety.

Create Free AccountSee the math behind the metrics. We show every calculation step so you understand exactly how value is derived.

Create Free AccountGet alerts when a company meets your screening criteria or hits your target Margin of Safety.

Create Free AccountTrack the valuation gap and safety margins of your priority stocks in a real-time dashboard.

Create Free AccountFilter the Signal from the Noise

Screen global markets using rigorous DCF models to find companies that match your exact valuation criteria.

Create Free AccountTake Control of Your Assumptions

Define your own growth and risk inputs to calculate a personalized Fair Value and Margin of Safety.

Create Free AccountAudit the Math (Zero Black Boxes)

See the math behind the metrics. We show every calculation step so you understand exactly how value is derived.

Create Free AccountNever Miss a Valuation Shift

Get alerts when a company meets your screening criteria or hits your target Margin of Safety.

Create Free AccountCurate Your High-Conviction List

Track the valuation gap and safety margins of your priority stocks in a real-time dashboard.

Create Free AccountMarket data is displayed as observed at market close on 2026-02-03 and 2026-02-04.

Analyze companies with transparency, confidence, and full control.

Try Value Sages FreeFor value investors seeking data-driven insights, our platform offers effortless intrinsic value calculation, detailed financial data, easy to grasp visualization, and margin of safety indicators rooted in all aspects of portfolio and watchlist management.

The CARE Framework: How to Filter Market Noise & Find Value

From the Learn Hub

Made By Enthusiasts

We craft solutions that amplify key characteristic, achieving a harmonious balance of function and intent

Anani

Ananiev

Co-Founder

Our Product Is A Solution For:

Frequently Asked Questions.

The margin of safety is calculated as the difference between an asset’s intrinsic value and its market price, expressed as a percentage of intrinsic value. It represents the cushion an investor has against potential errors in valuation or unexpected market fluctuations.

Fundamental analysis evaluates a stock or asset's intrinsic value by analyzing financial statements, industry trends, economic conditions, and company management. It assesses revenue, earnings, growth potential, and competitive advantages to determine long-term investment worth.